A five-year geological studied completed in 2017, which was carried out by a team from Alrosa, the Russian mining company that has invested substantial amounts in the Angolan industry, estimated that the country’s unmined diamonds could be as high as 1.5 billion carats, which was about 11 times total world production per year.

According to data released by Victor Ustinov, head of the Alrosa department responsible for evaluating diamond deposits in new territories, Angola has at least 950 million carats of rough diamonds in known kimberlite deposits and more than 50 million in alluvial areas. This figure could climb to 1.5 billion carats if the research is continued, he said.

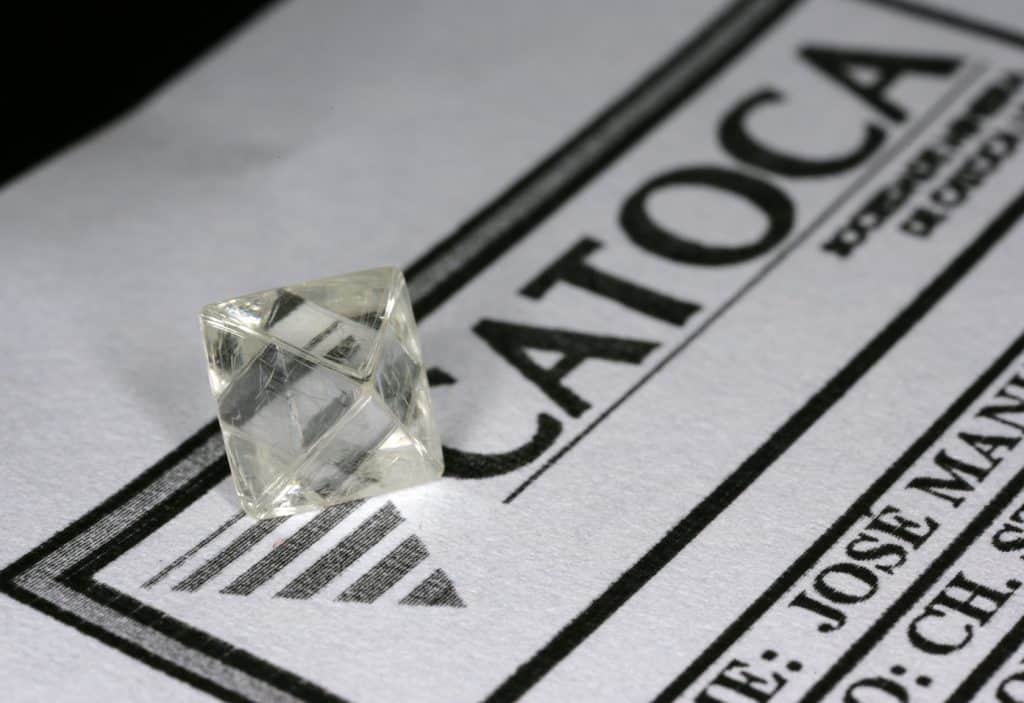

There currently are four producing diamond mines in Angola, with the Lulo mine being the most recent to come on line. The largest operation is the Catoca Diamond Mine, which is considered the world’s fourth-largest kimberlite mine in the world, covering some 64 hectares. The other facilities include the Luarica diamond mine and the Fucauma mine.

In August of last year, the country’s mining minister said that three new mines would come on stream over the coming five years.