Blog

Home » Diamonds blog » DE BEERS REPORTEDLY SET TO SHAKE UP ROUGH DIAMOND MARKET BY CUTTING NUMBER OF FIRMS ELIGIBLE FOR DIRECT SUPPLY

Focus on

According to Bloomberg, when De Beers meets is about 80 sightholders in January in Botswana for the company’s first sale of the year, the clients have been have been told to expect an update on possible changes.

For its part, De Beers is keeping its cards close to the chest. Its spokesman declined to comment on the Bloomberg report. “We will be communicating directly with customers in the coming months about the new contract, which will focus on maximizing the opportunities in the new diamond world,” the company noted in a statement.

No immediate change is expected, however. The mining company’s current contract, which has been in force for six years, only expires at the end of 2020.

SIGHTHOLDER SYSTEM DEVELOPED IN THE 1930S

It was the then De Beers chairman, Ernest Oppenheimer, who set up in 1934 the system that essentially would come to regulate the flow of diamonds. He dissolved the london Syndicate and established for De Beers, in which all of Anglo American’s diamond assets were now concentrated, a new rough diamond marketing subsidiary called the Diamond Trading Company (DTC).

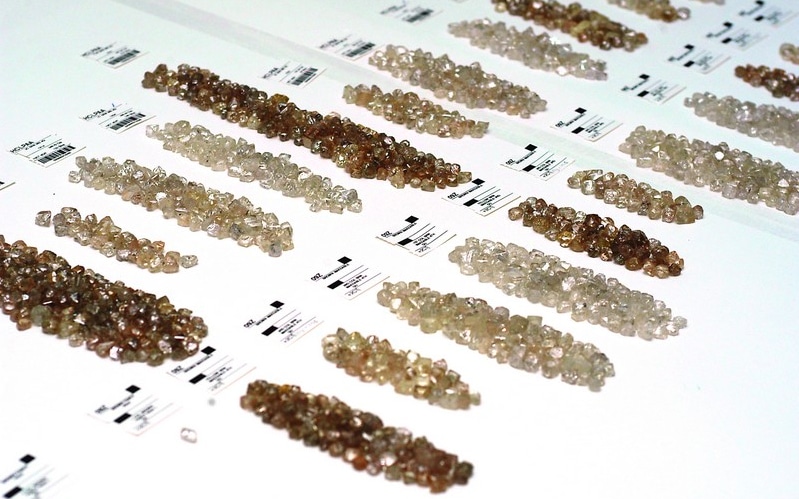

The DTC mixed rough diamonds from the various mines under its control, setting standard selling prices for each category instead of charging different prices from each producer. It also created the system by which selected clients, or sightholders, would be allowed directly to buy goods directly from it at 10 sales events, or sights, during each calendar year.

Sights were conducted on a “take it or leave it” basis, with sightholders not being permitted to cherry-pick from what was being offered to them. Immediate cash payment was required, and there were no price negotiations. But these were offers that sightholders rarely refused, for they knew that if they did so they were unlikely to be invited back.

The DTC acted as the market regulator. Prices were adjusted upward if market conditions warranted, but they were never cut. During periods of low demand or overproduction, De Beers would add to what became known as its buffer stockpile.

Ernest Oppenheimer, De Beers’ former chairman, who in 1934 established the Diamond Trading Company, and with it the sightholder rough sales system.

Fancy yellow diamonds produced at the Ellendale Mine.

ROUGH TENDERS TAKE SIGNIFICANT MARKET SHARE

When De Beers introduced its Supplier of Choice strategy in 2001, part of which involved relinquishing its role as the industry’s patron, it more than halved the number of sightholders, and established for those that remained two-year, renewable term limits, which later were raised to 30 months, after which clients could apply for renewal.

In 2009 its relinquished the “take it or leave it” requirement and allowed its clients to defer all or part of their sight allotments.

At the same time the rough distribution system was changing, with tenders to the highest bid playing a greater role.

De Beers made its first move in 2007, when it reorganized its Diamdel rough sales subsidiary. Selling 10 percent of the mining company’s run-of-mine production, Diamdel began offering 70 percent of what it had to sell by tender. In 2012, Diamdel was renamed De Beers Auction Sales and began selling all its rough through the tender or auction process.

In 2013, when De Beers began auctioning a portion of its Botswana production through the Okavango Diamond Company, through rough tenders held every five weeks.

Alrosa, which today is the world’s largest diamond producer by volume and value, also began developing its tender sales channel, and by 2014 the Russian company was selling about a quarter of its production through this channel. By then, Rio Tinto, which had got the ball rolling almost 30 years earlier was selling about 10 percent of its production by value through auctions or tenders.

The proliferation of smaller producers led to significant growth in the number of tender sales. This led to the creation of new business sector of diamond tender auction consolidators such as Hennig Tenders and Koin International Diamond Tenders. The Rapaport Group also set up tender operation.