Blog

Home » Diamonds blog » DOES LVMH’S FORAY INTO LAB-GROWN DIAMONDS SIGNAL LUXURY BRANDS’ ACCEPTANCE OF SYNTHETIC GOODS?

Focus on

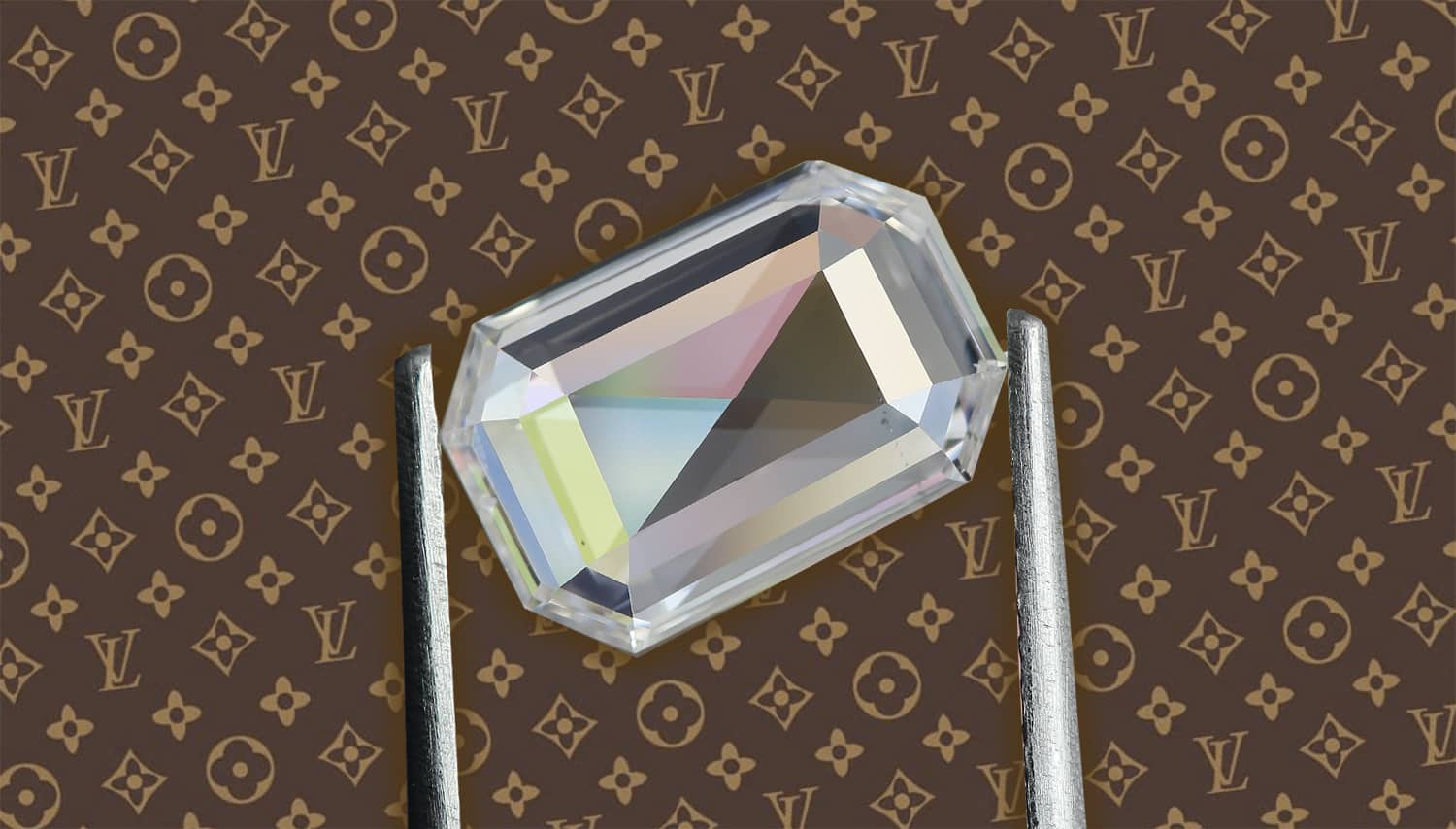

The recent announcement by LVMH, the world’s largest luxury brand house, according to which it would be directing funds of an undisclosed value from its investment arm, LVMH Luxury Ventures, into an Israeli laboratory-grown diamond startup, may well be regarded as a giant step in the journey that the synthetically produced diamond industry has been taking in obtaining wide-spread acceptance.

To date, while an increasing number of diamond companies in the midstream of the distribution chain have been climbing on the LGD bandwagon, the top luxury brands have been more circumspect. Last year Cartier CEO Cyrille Vigneron told a Business of Fashion special report that lab-grown do not have “singularity,” and they lack “the fact that they were made by the Earth millions of years ago.”

As a mass-produced product that has seen its price fall to a fraction of where it stood just five years ago, the feeling by many in the industry is that while laboratory-gown goods do have place in the marketplace, it is more likely in fashion jewelry rather than in the finer product. But LVMH’s decision to invest money in an LGD operation indicated that, at the very best, one of the leading players is hedging its bets. This is the company that in early 2020, just months after acquiring Tiffany & Co. for $16.2 billion, bought the 1,758-carat Sewelo, the second largest rough diamond ever to have been discovered.

LVMH, which many associate with luxury handbags and champagne, has a long jewelry history, with a strong emphasis on diamonds. In addition to Tiffany, it has in its stable such venerable brands such as Bulgari, Chaumet, Fred and Repossi, and until 2017 had a 50 percent share in De Beers Diamond Jewellers, before that was bought out by Anglo American.

So when LVMH takes the plunge and invest in a lab-grown diamond company, the world takes pause to think about the consequences.

Benny Landa, the Canadian-Israel high tech entrepreneur, who pioneered digital printing and now has invested in the laboratory-grown diamond sector.

DIGITAL PRINTER MEETS DIAMONDS

The company that LVMH chose to invest is unusual in itself. It was founded by Benny Landa, a Canadian-Israel high tech entrepreneur, who many consider to be the father of commercial digital printing.

In 1993, the company that he has established 16 years earlier, Indigo Digital Printing, introduced the E-Print 1000, a digital color printing press that enabled printing from a computer file directly onto paper, bypassing the standard process by which four separate runs were required to obtain a full-color printed page.

In 2002, Landa sold Indigo Digital Printing to Hewlett-Packard for $830 million. A year later he founded Landa Labs, a science innovation and incubation center that today has a staff of about 200 people, including chemists, physicists, materials scientists and engineers. It is involved a variety of fields, from nano-organic pigments to nano drug delivery, printed electronics and solar energy.

Lusix Diamonds, which is the group bills as the first company in the world to commercially grow exceptional gem-quality diamonds harnessing only the power of the sun, gets all the electricity it requires to power the production process via a dedicated solar farm situated in the south of Israel. It this presents it output as environmentally friendly, and to back that up has had its lab-grown stones certified as Sustainability Rated Diamond by SCS Global Services, a third-party sustainability verification authority.

LUXURY GETS ON THE BAND WAGON

While LVMH is certainly the most prominent luxury brands to climb onto the LGD wagon, it is not the only well known name to have associated itself with man-made diamonds.

Several months ago, Pandora, the Danish company that is a world’s largest jewelery producer, announced that it will no longer sell natural, mined diamonds, switching exclusively to stones manufactured in the lab.

But Pandora was never really known as a producer of diamond-set jewelry, with its largely silver product range generally regarded as high-end fashion jewelry. A more prominent maverick is Luximpact, which was established by two jewelry industry veterans, Frédéric de Narp, formerly president and chief executive of Cartier North America, and Coralie de Fontenay, a former managing director of Cartier France, who earlier has worked together at Harry Winston. The company’s creative director, Sandrine de Laage, worked for Cartier in Paris and Hong Kong.

Laboratory-grown diamond jewelry by Pandora.

Based in Paris, Luximpact specializes in what considers responsible jewelry brands.

Quoted earlier this year by the New York Times, Mr. de Narp said that “it’s time to change the codes of an industry that’s not reinventing itself, or at least not fast enough for us.”

The company has revived an historic French brand called Oscar Massin, using only recycled gold an platinum, set with lab-grown diamond