Record-Breaking Sparkle: Top Gems Shine at a Recent Christie’s Magnificent Jewels Sale in Geneva

Christie’s Magnificent Jewels sale in Geneva achieved 140% of its low estimate with total sales over $54 million, highlighting strong market demand

The diamond necklace commissioned by King Louis XV became entangled in a scandal that greatly tarnished Marie Antoinette’s reputation, despite her lack of involvement.

Jeanne de La Motte orchestrated an elaborate scheme involving forged letters and impersonation to deceive Cardinal de Rohan and the jewelers into believing the queen desired the necklace.

The necklace affair exacerbated public discontent with the French monarchy, contributing significantly to the revolutionary sentiments that culminated in the French Revolution.

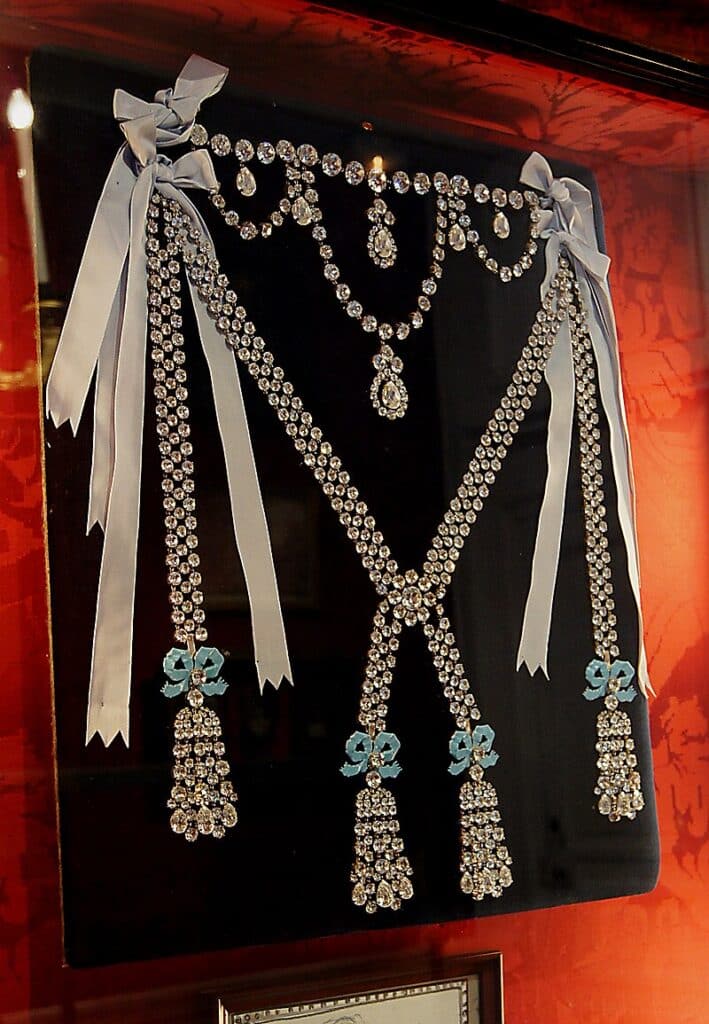

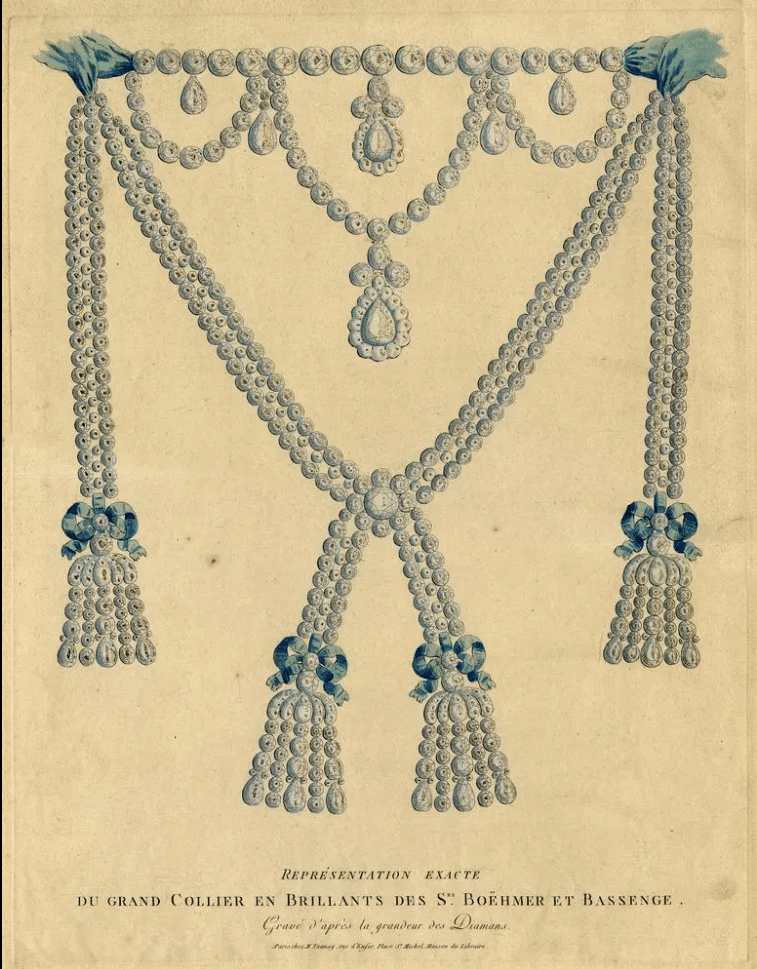

Commissioned by King Louis XV for his mistress, Madame du Barry, the infamous diamond necklace was a marvel of luxury and extravagance. Its features included:

17 large diamonds, like stars plucked from the heavens

A constellation of smaller gems, totaling nearly 650 diamonds in all

Skilled craftsmanship by the Crown jewelers, Böhmer and Bassenge

Yet, for all its splendor, the necklace would become entangled in a web of deceit that hastened the demise of the French monarchy.

The diamond necklace affair, a scandal of such magnitude, shook the foundations of the Ancien Régime. As the story of the necklace’s creation, the intricate scheme to sell it, and the ensuing fallout unfolded, it became a symbol of the unchecked opulence that fueled the flames of the French Revolution. This magnificent diamond necklace, intended for one woman, would become the albatross around the neck of another. Marie Antoinette, Queen of France, would bear the brunt of the scandal, her name wrongfully sullied by association with an item she neither desired nor possessed.

The birth of the diamond necklace was shrouded in the allure of forbidden love, a gift from a king to his mistress. King Louis XV, seeking to adorn Madame du Barry with the finest jewels, commissioned a necklace so extravagant that it would become the envy of all Europe. It was not merely jewelry; it was a statement of power and passion. The Crown jewelers, Charles Auguste Boehmer and Paul Bassenge, poured their expertise into crafting a masterpiece, embedding nearly 650 diamonds into an artwork of unparalleled beauty.

Yet, despite its grandeur, the magnificent diamond necklace remained unsold upon the king’s death. The desperate jewelers sought to recoup their investment, offering the necklace surreptitiously to the French court’s new queen, Marie Antoinette. However, the queen refused, aware of the necklace’s association with Madame du Barry and the potential scandal it represented. This refusal set in motion a chain of events that would entangle the necklace in a scandal of historic proportions, one that would tarnish the reputation of the queen and the jewelers alike.

The diamond necklace affair embroiled Queen Marie Antoinette in a drama not of her making, casting her as a central figure in a plot that would capture the imagination of a nation. The stage was set for an epic unraveling, a brief nocturnal interview that would forever taint the public’s perception of the queen. It was a tale of greed and deception, a scandal that played out against the backdrop of a society marked by opulence and inequality. As the narrative unfolds, we find ourselves immersed in the dark underbelly of the French court, where every shadow holds a secret and every whisper could be the downfall of an empire.

The captivating beauty of colored diamonds was also showcased, with the fancy-intense-pink diamonds captivating bidders and demonstrating robust market performance. Each gem was a note in a symphony of color, a hit that left the audience mesmerized.

In the years preceding the French Revolution, Marie Antoinette, also known as Marie Antoinette de France, was a young queen caught in a maelstrom of public scrutiny. She was a foreigner in the French court, a daughter of Empress Maria Theresa thrust into a role that would challenge her at every turn. The nocturnal interview, contrived and cloaked in deception, was but a prelude to the chaos that would engulf her reign and lay bare the vulnerabilities of the French monarchy. This introduction serves as our guide into the labyrinthine world of royal intrigue, where the truth is often stranger than fiction, and the consequences of a single misstep can echo through the annals of history.

However, of all the colored and colorless diamonds, it was the yellow diamonds that truly shined.

Enter Jeanne de La Motte, also known as the Comtesse de la Motte, a name that would become synonymous with one of the greatest cons in French history. Born of fallen nobility and possessing a cunning mind, de La Motte saw in the necklace an opportunity to ascend once more. With audacious ingenuity, she orchestrated a ruse that would ensnare Cardinal Rohan, convincing him that the queen wished to acquire the necklace discreetly. The plot required a counterfeit queen, and so, under the cloak of darkness, a brief nocturnal meeting was arranged, sealing the cardinal’s fate.

De La Motte’s intricate scheme hinged on deception and forged letters, with the cardinal acting as the unwitting pawn in her game. The jewelers, eager to dispose of the necklace, were persuaded that the queen herself had commissioned the cardinal to secure the treasure. But it was all an elaborate facade, with Countess de la Motte at the center, spinning her web of lies. She was the countess of deceit, masquerading as Marie Antoinette’s lady, using the allure of the necklace as bait in a trap that would ensnare not only the cardinal but the reputation of the queen as well.

Cardinal de Rohan, a man of ambition and lineage, found himself thrust into the heart of the affair during the reign of Louis XVI, his desire to regain the queen’s favor his undoing. Deceived by the artifice of Jeanne de La Motte and a prostitute disguised as the queen, the cardinal believed he had been restored to Marie Antoinette’s good graces. It was a belief that led him to negotiate with the jewelers, securing the extravagant necklace on behalf of a queen who knew nothing of it.

The cardinal’s role as intermediary was a tragic misstep. He believed the queen wished to possess the necklace surreptitiously, relying on forged letters and a furtive nocturnal encounter as proof of her endorsement. When the desperate jewelers presented the necklace, Cardinal Rohan, in his misplaced trust, handed it to Jeanne de La Motte, who promptly vanished with the prize.

The cardinal, a man of the cloth, found himself entangled in a secular scandal during the reign of King Henry II, his reputation and that of the monarchy hanging precariously in the balance.

Marie Antoinette, the queen consort of France, found herself caught in a web of lies and deceit through no fault of her own. Despite the rumors and forged letters, Marie Antoinette refused the necklace, having done so on several occasions. The scandal painted a picture of a queen embroiled in intrigue, using intermediaries for her covert indulgences, a portrayal that could not be further from the truth.

The queen’s reputation, already marred by gossip and false narratives, suffered greatly at the hands of the affair. The public’s misconception of her involvement cast her as a frivolous spendthrift, a symbol of the excesses of a disconnected royal family. Yet, the truth remained that Marie Antoinette was innocent, her name unjustly sullied by the machinations of others. The queen’s alleged involvement would become a rallying cry for those who sought to challenge the French monarchy, her name forever linked to a necklace she never wore.

As the installments for the necklace went unpaid, the affair began to unravel, revealing a tangled plot of deception and greed. The jewellers, Böhmer and Bassenge, approached Queen Marie Antoinette, who expressed shock and denied any involvement, the first threads of the truth coming to light. Cardinal Rohan, the man who had so confidently presented the necklace, found himself arrested in the Hall of Mirrors, accused of orchestrating a fraudulent scheme.

The arrest of Cardinal Rohan was a spectacle that unveiled a complex web of deceit, including:

forged letters

the impersonation of the queen

Jeanne de La Motte’s accomplices, including the forger Rétaux de Villette and the prostitute Nicole Le Guay, were also apprehended, their confessions exposing the depth of the conspiracy

The plot, which had seemed so flawless to its architects, was disassembled as easily as the necklace itself, which had by then been smuggled to London and sold off in pieces.

The trial that ensued was a public spectacle, a theatre of justice where the fates of the accused would be decided by a Parisian firm, the Parlement de Paris. Cardinal de Rohan, despite his role in the affair, was declared innocent, his acquittal met with cheers from a public that had grown weary of royal authority. Jeanne de La Motte, the countess turned con artist, was not so fortunate, sentenced to a brutal punishment that elicited shock and sympathy from onlookers.

The public reaction to the trial was a mixture of:

vindication and horror

cheers for Cardinal Rohan’s acquittal, echoing a deep-seated animosity towards the perceived injustice of the monarchy

shock at the brutality of Jeanne de La Motte’s punishment, revealing the harshness of the Ancien Régime’s justice system.

The trial, meant to restore the monarchy’s image, only served to further erode its standing in the eyes of the public, the necklace affair becoming a symbol of the royal family’s alleged corruption and extravagance.

The necklace affair left an indelible scar on the face of the French monarchy, the public’s perception of royal extravagance reaching a fever pitch. As the scandal unfolded, it became a catalyst for revolutionary sentiments, the opulence of the necklace juxtaposed against the struggles of the common people. The monarchy, once the revered institution of France, found its authority and legitimacy questioned, the trial of Cardinal Rohan serving as a symbol of its ineffectiveness and perceived injustices.

The scandal, which had begun as a criminal enterprise, morphed into a political crisis, contributing to the decline of the Ancien Régime. The public’s disdain for Marie Antoinette and the monarchy was intensified by the affair, setting the stage for the upheaval that would soon engulf France. The necklace, a mere piece of jewelry, had become a potent symbol of a monarchy disconnected from its people, its legacy a harbinger of the tumultuous changes that the French Revolution would bring.

The diamond necklace affair was the coup de grâce to Marie Antoinette’s already flagging reputation, a scandal from which she would never recover. Her image, once that of a fashionable and cultured queen, was now marred by the false association with greed and extravagance. Though innocent, the public’s perception of her involvement in the affair cast a long shadow over her legacy, turning Marie Antoinette into a figure of near-hatred in the eyes of many.

Defamatory literature and scandalous mémoires flourished in the aftermath of the affair, painting the queen as the embodiment of the scandal itself. Jeanne de La Motte, despite being the mastermind behind the fraud, shifted blame onto Marie Antoinette in her memoirs, further tarnishing the queen’s image. The public’s appetite for gossip and scandal was insatiable, and Marie Antoinette, the last queen of France, became a convenient scapegoat for the nation’s ills.

The necklace affair has left a lasting imprint on French history, its legacy transcending the mere loss of a piece of jewelry. It became a symbol of:

the extravagance and perceived corruption of the French monarchy

fueling the revolutionary fires that would soon consume the nation

Marie Antoinette’s reputation, unfairly maligned by the scandal

a cautionary tale of how quickly fortune can turn and how vicious the court of public opinion can be.

The diamond necklace, once intended as a symbol of love and power, became a harbinger of downfall and revolution. The public’s reaction to the affair and the subsequent trial reflected a society on the brink of monumental change, with the necklace serving as a tangible manifestation of the disconnect between the ruling class and the populace. The affair of the necklace was not just a crime; it was a prelude to a seismic shift in the political landscape of France.

Ultimately, the necklace affair serves as a reminder of:

the power of perception

the fragility of reputation

the complexities of human nature

the allure of wealth

the perils of deceit

It stands as a testament to the larger societal forces at play, forces that would soon sweep away the old order and usher in an era of unprecedented change.

In summarizing the tale of the infamous necklace, one cannot help but reflect on the interplay of perception, power, and the precipitous fall of a monarchy. The necklace, a masterpiece of luxury, became an emblem of the systemic issues plagizing the French monarchy and a catalyst for the French Revolution. Marie Antoinette, a queen beset by scandal and intrigue, remains a figure of fascination, her image shaped by the unfortunate events surrounding a piece of jewelry she never desired. The diamond necklace affair, with its complex web of deceit and dramatic revelations, serves as a poignant example of the destructive power of rumors and the volatility of public opinion.

The legacy of the necklace lives on, a reminder of the dangers posed when luxury and power become disconnected from the realities of the common people. It is a story that resonates with timeless themes: the pursuit of wealth, the consequences of deceit, and the fragile nature of reputation. As we close this chapter of history, we are reminded that the echoes of the past continue to inform our understanding of the present, shaping our perceptions of leadership, privilege, and the delicate balance between appearance and reality. Let this account of the diamond necklace affair serve as both a lesson and a warning, a narrative that still holds relevance in our modern world.

VP Of Online Marketing - MID House Of Diamonds

Christie’s Magnificent Jewels sale in Geneva achieved 140% of its low estimate with total sales over $54 million, highlighting strong market demand

The 2024 Oscars showcased a display of exquisite jewelry from celebrity attendees, with Emma Stone dazzling a Louis Vuitton high jewelry collection

Storm Mountain Diamonds Pty Ltd SMD is pleased to announce that it has entered into an agreement with Choron BV Choron for