Blog

Home » Diamonds blog » Diamond Jewelry Tops Millennial Choice in China

Focus on

According to the Lead-Loe study, the market share of gold jewelry and ornamental items fell to 18.4 percent in 2018, down from 28.1 percent in 2011.

“Diamond jewelry is expensive and people buy it less frequently. They usually purchase after careful consideration. So, only renowned brands and top-quality diamonds with beautiful designs are more sought after by consumers,” said Li Zheng, a research manager at Lead-Leo, .

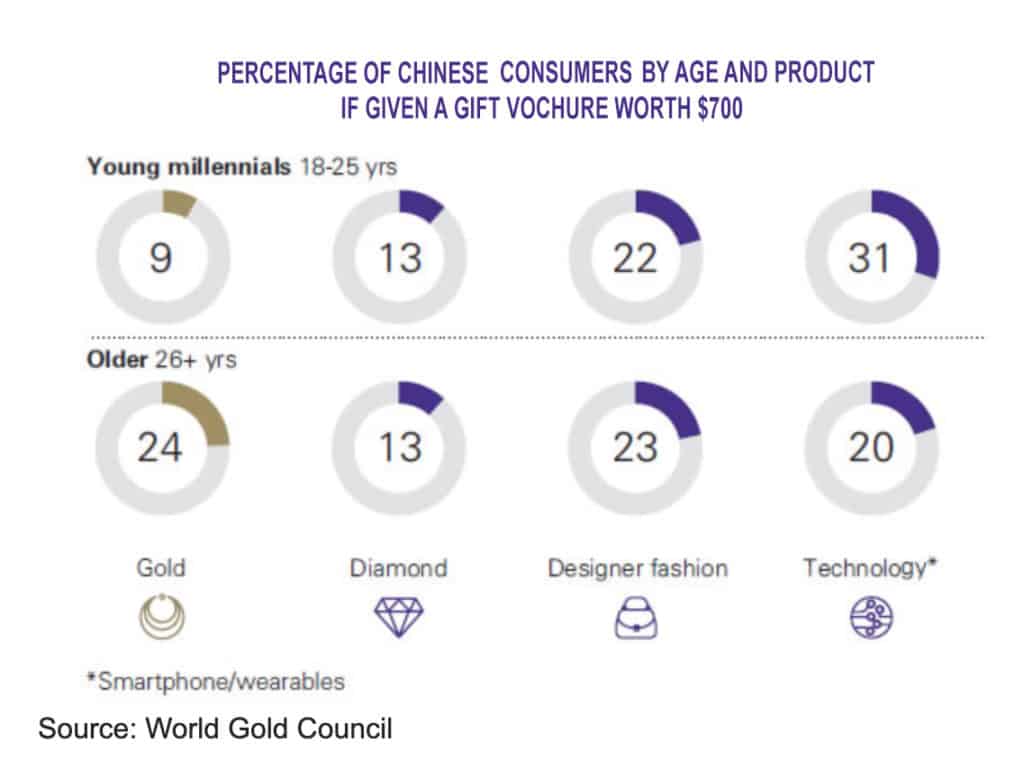

“Young Chinese consumers have become the backbone of diamond jewelry trade, and social media is an important channel for them to get related information, so it’s critical for diamond brands to raise their popularity and reputation through social media platforms,” he added.

Sales of diamond jewelry equaled $11.9 billion in China in 2018, with an annual compound growth rate of 10.4 percent registered in the past five years, according to Lead-Leo.

Over the coming five years, Lead-Loe predicts, the diamond jewelry sector could see growth in sales of more than 60 percent in terms of local currency.

AFTER TAILING OFF, GROWTH OF CHINESE MARKET ACCELERATING

According to the World Gold Council, China’s jewelry market currently accounting for about 30 percent of global demand.

Following rapid economic growth and rising wealth, demand peaked in 2013, and then tailed off, leaving the jewelry sector with too many stores, excess capacity and fierce price competition.

A period of reinvention followed, as Chinese jewelers focused on boosting their appeal to younger consumers. This was done with a a more diverse product mix and a massive digital presence. The efforts provided encouraging results, with demand for jewelry growing in 2017 for the first time in four years.

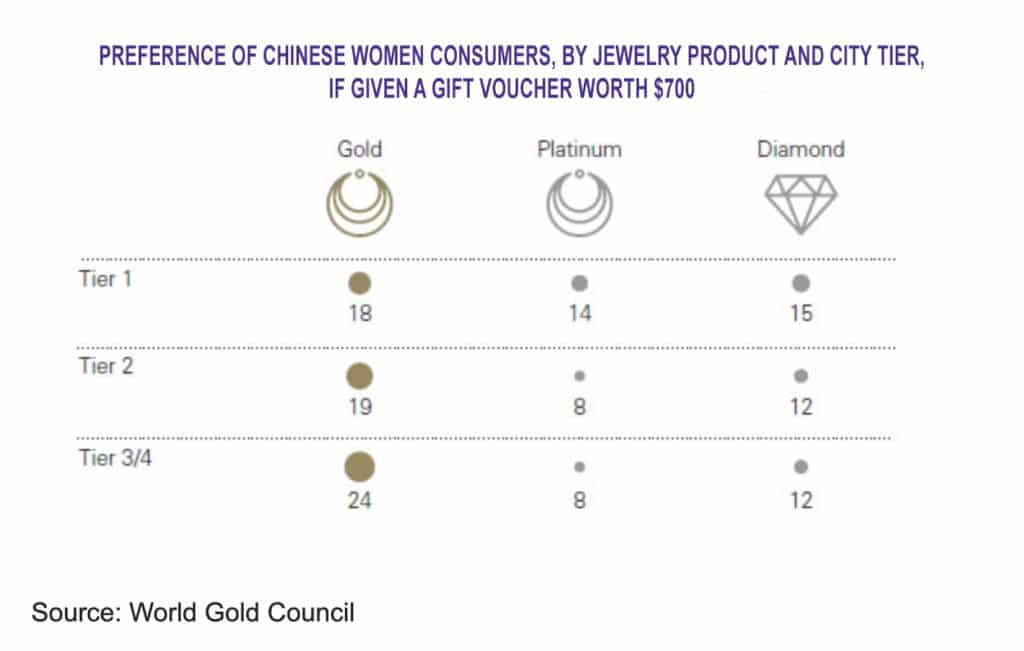

What had become apparent, according to the World Gold Council study, was in Tier 1 cities, diamond and platinum jewelry had become almost as almost as popular as gold products, although in lower-tier cities, by consumers still tend to buy high carat, heavy gold jewelry for wealth preservation purposes.

A recent study carried out by UnionPay, one of China’s largest financial services companies, showed that consumers in Tier 1 cities contribute around 40 percent of total national spending. The study also indicated that among millennials, the generation that the Lead-Leo research indicated is developing a preference for diamond-set jewelry, spending is increasing at twice the rate of spending by older consumers.

TIFFANY PLANS TO OFFSET AMERICAN DECLINE IN CHINA

One high-end jewelry company that is taking note is Tiffany & Co. , which is counting on growth in China to offset declining sales in North America, its largest market.

In a conference call with analysts, Tiffany said it plans on increasing investments in China during the second half of 019. It furthermore will upgrade its flagship store in Shanghai, concentrate on the development of its e-commerce platforms serving the Chinese market. These, the company believes, will enable it to reach customers in smaller cities, where it does not operate physical stores.

In 2018, Tiffany launched its first online limited-time pop-up store on the popular Chinese social media platform WeChat, and experienced better than forecast sales with a series of limited-edition necklaces.

Other international top brands have also launched similar pop-up stores on WeChat, aiming to attract more young Chinese consumers. They include Cartier, Gucci, Louis Vuitton and Swarovski.