Blog

Home » Diamonds blog » SIGNET TO CONSOLIDATE ITS STATUS AS LEADING DIGITAL PLAYER BY PURCHASING BLUE NILE FOR $360 MILLION

Focus on

Photo courtesy of Signet Jewelers.

Just five years ago, Signet Jewelers, the world’s largest diamond jewelry retailer appeared to be facing imminent disaster. Battling substantially lower sales volumes and earnings, a 69,000 person class-action gender discrimination lawsuit and a plunging share price, a variety of factors were said to be responsible. These included its decision to relinquishing its lucrative credit financing division, lower foot-traffic in malls and what many considered to be a lackluster online strategy.

Well, that was then. Despite the last several years having been punctuated by the COVID crisis, the Bermuda-registered jewelry chain that dominates the jewelry trade in the United States, Canada and the United Kingdom have seen its fortunes rise once again. Total sales equaled $7.8 billion during the fiscal year ended January 29, 2022, up $2.6 billion or 49.7 percent compared to the 12 months preceding it, with brick and mortar total sales up 56.2 percent to $6.3 billion, and e-commerce sales increasing 27.6 percent to $1.5 billion.

What possibly more impressive is that in a little more than five years Signet has transformed itself from an underperforming also-ran in the online diamond jewelry business to most probably its most important player, certainly in the markets where it is most active. Cognizant that its original strategy to go it alone was not really working, Signet went to out to buy talent, and in so doing turned its fortunes around.

In 2017, the corporation purchased R2Net, the owner of digital jeweler James Allen, for $328 million, and in 2021 acquired Rocksbox, an online jewelry subscription service that lets customers sample and possibly buy items for a monthly fee. At the same time, it pursued a digital strategy that interconnected its brick and mortar and online business, and approach that proved very timely during the months when store traffic slowed because of COVID.

The latest, and most significant development in its road to digital dominance was announced on August 9, when Signet revealed that it had signed a definitive agreement to acquire Blue Nile, pioneering online retailer of engagement rings and fine jewelry, for $360 million, in an all cash transaction. Blue Nile delivered revenue of more than $500 million in calendar year 2021.

AN ONLINE DIAMOND RETAIL PIONEER

The strategic acquisition of Blue Nile brings an attractive customer demographic that is younger, more affluent, and ethnically diverse, which will broaden its customer base, Signet stated in its announcement.

Founded in Seattle in 1999 by Mark Vadon, reportedly after he had a less than satisfying experience shopping for a diamond engagement ring through traditional retail routes, Blue Nile’s essential premise that choosing an engagement ring could be simple if done online. Providing full disclosure about every stone on offer, backed up by an extensive educational unit that enabled its customers to decipher the information they were being provided, within 10 years the company had become became one of the largest diamond and diamond engagement ring retailers in the United States.

Blue Nile went public in 2004 at $20.50 per share. Three years later its stock price had almost quintupled.

Blue Nile was acquired in 2017 by an investor group comprised of Bain Capital Private Equity, Bow Street and Adama for approximately $520 million, some $160 million more than the price at which Signet has just acquired the company.

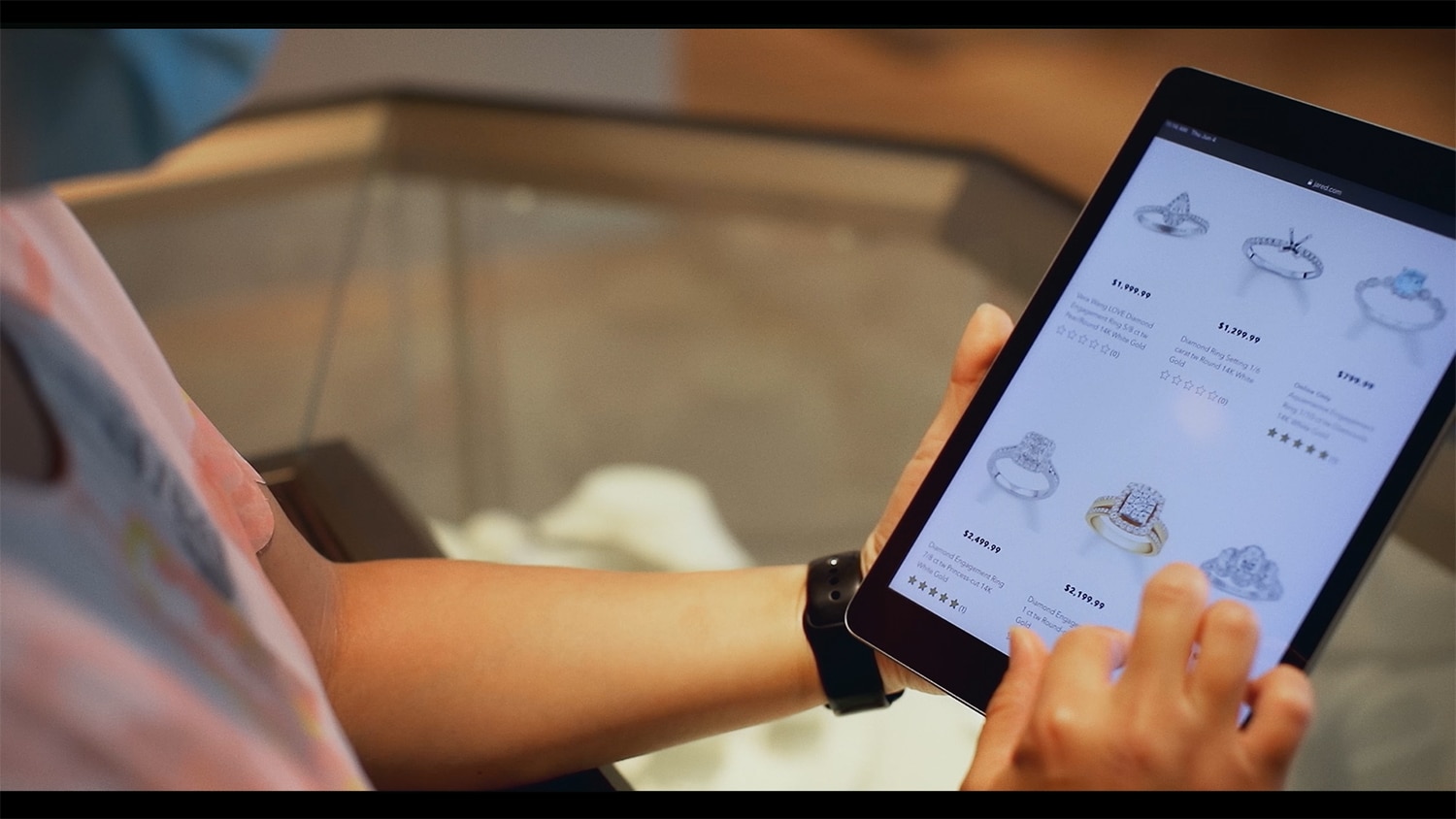

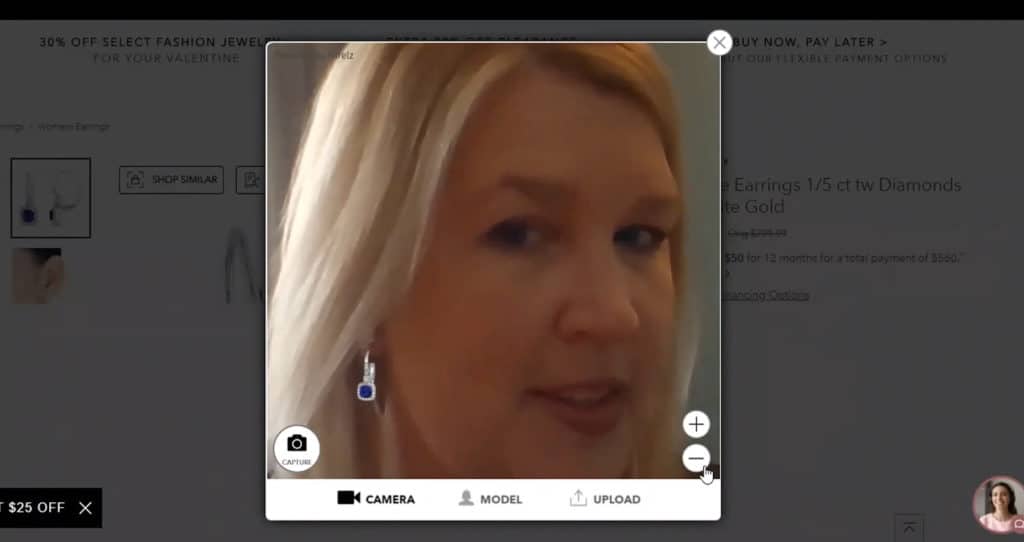

Signet’s strategy has been to blur the lines between its brick and mortar and online business, enabling customers to move seamlessly between them. This has included introducing applications that allows clients to chat face to face with sales staff and to try on jewelry virtually.

A LEADING E-COMMERCE BUSINESS

The deal is a not yet final, with either side able to pull out of the arrangement if it is not sealed by the beginning of November, but Blue Nile has already suspended an earlier planned for a stock-market flotation, via a merger with Mudrick Capital Acquisition Corporation II, for which the company was valued at $873 million.

“Blue Nile is a pioneer and innovator in online engagement rings and fine jewelry, providing a unique and highly desirable shopping experience for customers,” said Signet Chief Executive Officer Virginia C. Drosos.

“Adding Blue Nile to our strong and diversified portfolio of banners will further drive our Inspiring Brilliance growth strategy – expanding customer choice, building new capabilities, and achieving meaningful operating synergies that will increase value for both our consumers and shareholders,” Drosos stated.

“By joining Signet, we will extend our premium brand and fine jewelry offering to millions of new customers while bringing new capabilities to our leading e-commerce business that will drive additional growth opportunities for Blue Nile,” said Sean Kell, CEO of Blue Nile.

Signet plans to fund transaction with cash on hand.