Blog

Home » Diamonds blog » JEWELRY LAGS BEHIND U.S. RETAIL SALES GROWTH, WHILE UNCERTAINTY IN CHINA ABOUT MARKET RECOVERY

Focus on

Photo: Bing Hao on Unsplash.com.

The 2022 end-of-year holiday season has drawn to a close, and the sales results are now trickling in. According to Mastercard SpendingPulse, U.S. retail sales excluding automotive increased 7.6 percent for the period year-over-year, running from November 1 through December 24. But jewelry sales dipped 5.4 percent.

Mastercard SpendingPulse measures in-store and online retail sales across all forms of payment and is not adjusted for inflation.

Inflation was most definitely a factor in the United States. “This holiday retail season looked different than years past,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “Retailers discounted heavily but consumers diversified their holiday spending to accommodate rising prices and an appetite for experiences and festive gatherings post-pandemic.”

Online sales grew 10.6 per percent compared to the same period last year, the preliminary insights show. This holiday season, e-commerce made up 21.6 percent of total retail sales, up from 20.9 percent in 2021 and 20.6 percent in 2020. The channel continues to experience elevated growth as consumers prioritize convenience and availability of discounts.

“Inflation altered the way U.S. consumers approached their holiday shopping – from hunting for the best deals to making trade-offs that stretched gift-giving budgets,” said Michelle Meyer, North America Chief Economist, Mastercard Economics Institute. “Consumers and retailers navigated the season well, displaying resilience amid increasing economic pressures.”

U.S. CONSUMER CONFIDENCE RECOVERS

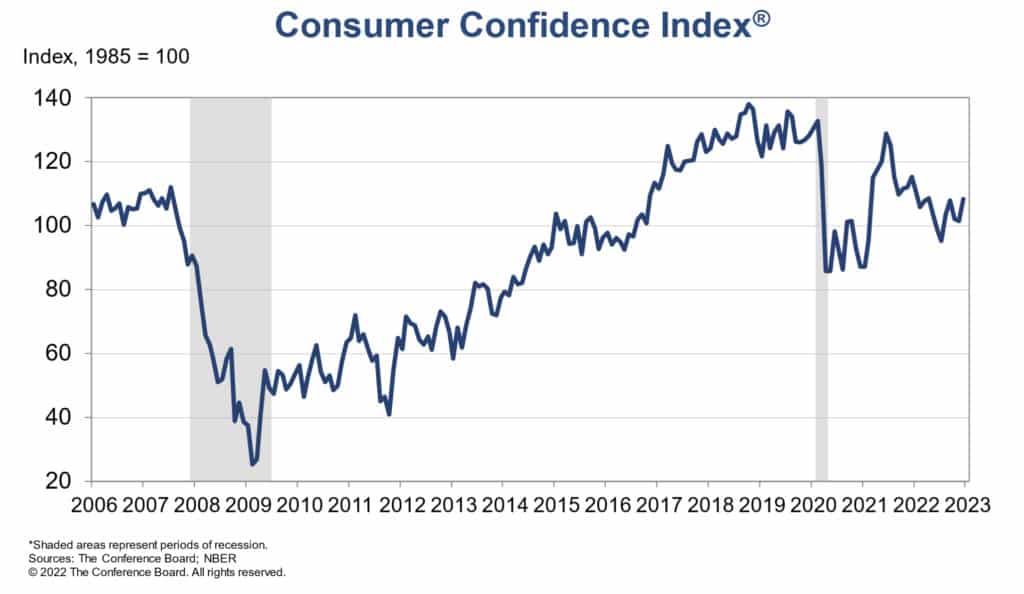

In terms of consumer confidence, there was good news. The Conference Board Consumer Confidence Index increased in December following back-to-back monthly declines. The Index now stands at 108.3 (1985=100), up sharply from 101.4 in November.

The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—increased to 147.2 from 138.3 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—improved to 82.4 from 76.7. However, Expectations are still lingering around 80—a level associated with recession.

“Consumer confidence bounced back in December, reversing consecutive declines in October and November to reach its highest level since April 2022,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation and Expectations Indexes improved due to consumers’ more favorable view regarding the economy and jobs. Inflation expectations retreated in December to their lowest level since September 2021, with recent declines in gas prices a major impetus.

“Vacation intentions improved but plans to purchase homes and big-ticket appliances cooled further,” Franco added. “This shift in consumers’ preference from big-ticket items to services will continue in 2023, as will headwinds from inflation and interest rate hikes.”

While high price luxury items, like fine jewelry, we not mentioned in the assessment, it is possible that they are being impacted in the same way as pricey home electronics.

CHINA ENDS NO-COVID STRATEGY

There has been some optimism about a pending improvement in the Chinese market, as a result of the country’s regime decision to discontinue its no-COVID strategy, which had inflicted ongoing lockdowns and stoppages t a time that most other countries has returned to mormal operation.

Fitch Ratings expects China’s relaxation of pandemic control measures to revive retail sales in 2023, but cautions that the recovery trajectory is likely to be bumpy and slow during the initial phase of reopening, due to an expected sharp increase of COVID-19 cases, increased absenteeism in the retail workforce, and weak consumer confidence in employment and income prospects.

“We expect retail sales growth to remain sluggish in the near term as Covid-19 spreads rapidly, discouraging outdoor shopping” the report stated. “Spiraling confirmed case numbers in the past few weeks have also dampened labour productivity and caused widespread disruptions in manufacturing supply chains.

China’s total retail sales were down 5.9 percent year-on-year in November 2022, after falling 0.5 percent year-on-year in October. Total retail sales growth through the end of Novemer were down 0.1 percent year-on-year, which is moderate, but had considerable impact given the market’s reliance over the past several years of very large Chinese growth rates.

China’s central government has expressly declared is intention to revive domestic consumption, publishing its Outline of Strategic Planning for Expanding Domestic Demand (2022-2035) on 14 but Fitch stated that its expects the pace of retail sales recovery to remain uncertain, subject to the extent of pandemic-related productivity disruptions and improvements in sentiment and employment.