The Synthetic Diamond Bubble Has Burst: Why Consumers Are Returning to Natural Stones

The diamond industry is experiencing a significant shift as lab-grown diamond prices are crashing due to oversupply and increased production in China

Blog

Home » Diamonds blog » EU Diamond Regulation 2026

January 1 is recognized as the first day of the new year in most of the world due to the adoption of the Gregorian calendar, which was introduced by Pope Gregory XIII in 1582. This calendar reform established New Year’s Day on January 1, a tradition that has persisted for centuries and is now observed by most people globally. The history of this calendar system and the establishment of January 1 as the year’s day have made it a significant moment for new beginnings, compliance changes, and fresh starts. As a result, many new laws, regulations, and international agreements often come into effect on this globally recognized new year’s day, which serves as a chapter break for countries and organizations worldwide. For example, Bulgaria officially became the 21st member of the Eurozone on January 1, 2026; Liechtenstein became the 37th country to legalize same-sex marriage on January 1, 2025; Ukraine ended its gas transit agreement with Russia’s Gazprom on January 1, 2025; the expanded U.S.

Travel Ban began on January 1, 2026, suspending visa issuance for nationals of 39 countries; California enacted new laws on pay transparency and banned all plastic grocery bags on January 1, 2026; New York State’s minimum wage rose to $17.00/hour in NYC and $16.00/hour for the rest of the state on January 1, 2026; and on January 1, 2025, a man carried out a vehicle-ramming and shooting attack in New Orleans, killing 14 people. The celebration of New Year’s Day often includes making resolutions as part of a fresh start, and the ‘fresh start effect’ explains why people feel motivated to make changes at the beginning of the year, viewing it as a chapter break.

This article gives you a clear, practical checklist: what to ask for, when to ask for it, and how to spot a problem before it turns into a customs hold.

From this date, importers bringing polished diamonds into the EU that fall under the sanctions scope must submit a Due Diligence Statement on Diamond Origin as part of the customs documentation. The key difference from the previous process is that importers now need to provide this specific statement and supporting documents, whereas earlier requirements did not mandate such detailed documentation.

In this statement, the importer declares that the diamonds are not of Russian origin and confirms that this was verified through suppliers and supporting documents.

One important point: at this stage, the EU does not require all companies to use a single mandatory digital traceability platform. Instead, authorities require a formal declaration supported by documentation, which national customs offices will review in practice.

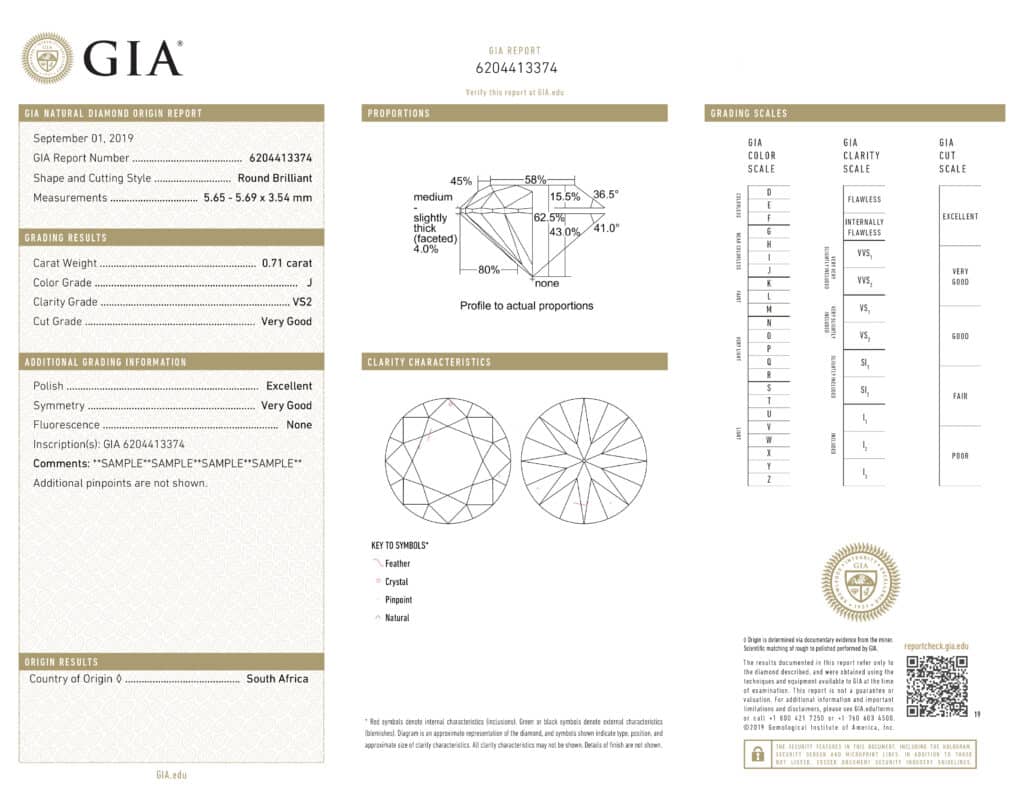

A grading report is not a proof of origin. For EU-bound diamonds, origin documentation matters just as much.

The surge in lab-grown diamond production, combined with the growing popularity and rising popularity of lab-grown diamonds among consumers—especially younger buyers—initially led to a significant price slump and a surge in demand, making lab-grown diamonds less appealing to some consumers as oversupply set in.

Natural diamonds, on the other hand, are seeing renewed interest, especially in the key bridal market, as younger jewelry buyers shift preferences back to natural stones. This shift is particularly notable among younger buyers and is influenced by the decline in the wholesale price of one carat lab-grown diamonds.

The diamond industry is experiencing a major shift, with the World Diamond Council head stating that the bubble has burst. This shift back to natural diamonds is being observed at the retail level, where retailers and consumers are increasingly favoring natural stones over lab-grown alternatives.

Increased production in China and India has caused lab-grown diamond prices to crash, impacting the diamond market and consumer confidence.

The natural diamond industry is benefiting from the decline of lab-grown diamonds, with natural diamond prices remaining stable. According to the latest trends lab grown, there is a noticeable decline in the appeal of lab-grown diamonds, reflecting broader industry movements and changing consumer preferences.

This matters to you if you:

Buy polished diamonds for clients in the EU

Export or import through an EU-based company

Ship diamonds to trade shows or inventory in Europe

Work with clients who demand “Non-Russian origin” as a legal requirement, not a marketing phrase

While the regulation targets EU importers, in reality the documentation request moves backward along the supply chain — straight to you.

Lab grown diamonds are transforming the world of jewelry, offering a modern, sustainable alternative for anyone looking to purchase an engagement ring or add a new piece to their collection. As we move into 2026, these stones are more popular than ever, especially among buyers who value both beauty and responsibility.

So, what exactly are lab grown diamonds? Unlike traditional diamonds that form deep within the earth over millions of years, lab grown diamonds are created using advanced technology that mimics the natural process. A tiny diamond “seed” is placed in a controlled environment, where it’s exposed to high temperatures and pressures. The result is a diamond that’s chemically, physically, and optically identical to those mined from the earth. Whether you’re looking at carat weight, clarity, or the way the diamond sparkles in the light, lab grown diamonds deliver the same quality and brilliance as their natural counterparts.

One of the most appealing aspects of lab grown diamonds is their value. Because they’re created in a lab, these diamonds typically cost up to 30% less than mined stones of similar carat weight and quality. This means you can choose a larger or higher-quality diamond ring without stretching your budget. Plus, lab grown diamonds are a more sustainable choice, reducing the environmental impact associated with traditional mining.

Ethical sourcing is another major advantage. Lab grown diamonds are free from the concerns that sometimes surround the diamond mining industry, making them a socially responsible option for your next jewelry purchase. When shopping for lab grown diamonds, always look for certification from respected organizations like the Gemological Institute of America (GIA) or the International Gemological Institute (IGI). These certificates confirm the diamond’s origin and provide details on carat, clarity, and other key characteristics, so you know exactly what you’re getting.

In terms of style, lab grown diamonds are as versatile as they are beautiful. They can be set in classic white gold, romantic rose gold, or timeless platinum, and work perfectly in everything from solitaire engagement rings to intricate multi-stone designs. Many buyers love the subtle differences that lab grown diamonds can offer, whether it’s a unique cut, a specific carat weight, or a custom setting that tells your personal story.

As the Gregorian calendar marks another new year, January is the perfect time to celebrate new beginnings with a lab grown diamond ring. Whether you’re in America, Europe, or anywhere else in the world, these stones offer a fresh approach to jewelry—combining quality, style, and peace of mind.

If you’re ready to begin your search, remember: lab grown diamonds are not just a trend—they’re a smart, beautiful, and responsible choice for the future. With their exceptional clarity, dazzling sparkle, and wide range of styles, there’s never been a better time to discover the difference a lab grown diamond can make.

If the destination is the EU, treat this as a core document. Without it, the EU importer is immediately exposed to customs risk.

Check that the statement includes:

Company name, signature, and date

Clear language stating the diamonds are not of Russian origin

Confirmation that the company verified this through suppliers and documentation, not assumptions

EU guidance focuses on the ability to demonstrate, “to the best of knowledge and based on available documents,” that the diamonds are not of Russian origin.

In practice, ask for a minimal but solid package:

Invoices along the supply chain (at least one step back, from a trusted supplier)

Relevant shipping documents (air waybill, packing list, export document if available)

A detailed supplier declaration — not a generic one-liner

Vague paperwork creates problems. Make sure the documents match the stones in your hands:

Weight or weight range: The diamond’s weight is measured in carats, which is the standard unit for documenting and valuing diamonds. Always verify that the carat weight listed matches the diamond’s weight in your possession. Remember, carat measures a diamond’s weight, but the apparent size is also influenced by the quality of the cut.

Number of stones

Laboratory report numbers, if applicable

Full consistency between goods, invoices, and declarations

Ask directly: “Can you state the origin of the rough, even if the diamond was polished in another country?”

The sanctions also target routes where Russian rough is processed in third countries. Saying “polished in India” or “sourced from Antwerp” is not enough.

‘Polished in India’ describes where the diamond was cut, not where the rough originated — and origin is what EU regulations require.

The cut of a diamond is more than just a matter of style—it’s a key factor in both the stone’s beauty and its compliance with industry standards. In 2026, round, princess, and emerald cuts remain the most sought-after shapes, each designed to maximize sparkle and showcase the diamond’s natural brilliance. A well-cut diamond reflects light beautifully, creating the fire and scintillation that make diamonds so captivating. On the other hand, a poor cut can leave even a high-carat stone looking dull and lifeless.

For compliance, it’s essential that every cut diamond is accurately described and graded according to standards set by the Gemological Institute. This ensures that buyers receive exactly what they expect, and that all documentation matches the physical characteristics of the stone. When reviewing paperwork, pay close attention to the cut grade and shape listed—these subtle differences can affect both the value and the legal standing of your purchase. In a market where transparency is everything, understanding the impact of cut and shape is crucial for anyone buying or selling diamonds in Europe.

hen it comes to diamonds, color and clarity are two of the most important factors influencing both beauty and value. The industry-standard 4Cs—carat, color, clarity, and cut—remain the foundation for evaluating any diamond purchase in 2026. Colorless diamonds, graded D-F, are prized for their pure, icy light, while stones with hints of yellow or brown (K-Z) offer a more accessible entry point for buyers. Clarity measures the presence of internal inclusions or external blemishes, with flawless diamonds being exceptionally rare and valuable.

Under the new EU rules, every diamond’s grading report must clearly state its color and clarity, ensuring full transparency for buyers. This detailed information helps you understand exactly what you’re purchasing and protects you from overpaying for stones that may not meet your expectations. Whether you’re investing in a high-carat showpiece or a delicate piece for everyday wear, knowing the color and clarity of your diamond is essential for making a confident, informed purchase.

For compliance, it’s essential that every cut diamond is accurately described and graded according to standards set by the Gemological Institute. This ensures that buyers receive exactly what they expect, and that all documentation matches the physical characteristics of the stone. When reviewing paperwork, pay close attention to the cut grade and shape listed—these subtle differences can affect both the value and the legal standing of your purchase. In a market where transparency is everything, understanding the impact of cut and shape is crucial for anyone buying or selling diamonds in Europe.

Send this exactly as written:

“Please provide a signed Due Diligence Statement on Diamond Origin.”

“Please include a detailed supplier declaration confirming the diamonds are not of Russian origin and explaining the basis for this confirmation.”

“Please attach the relevant invoice and shipping document linking the stones to the declaration.”

“Please include a stone list with weight/quantity and laboratory report numbers, if available.”

“Please confirm the documents are suitable for EU-bound shipments as of January 1, 2026.”

Overly generic statements

“Not from Russia” without naming who declares it, what it covers, and what evidence supports it.

Mismatched numbers

Stone counts or weights that don’t match across invoices, packing lists, and declarations. Understanding the difference between documentation details—such as stone counts, weights, and supplier declarations—is crucial to avoid delays caused by these inconsistencies.

Gaps in the supply chain

No document clearly connecting your supplier to the stated origin.

Inconsistent dates

Invoices or shipments dated after the point you rely on for origin claims.

Assuming “this is the importer’s problem”

At the moment of clearance, the importer will push the issue straight back to you.

Build a standard “EU shipment document pack”

Track which suppliers provide clean, consistent documentation and which don’t

Add a mandatory step: verify stone lists against documents before the goods leave the vault

This is not extra bureaucracy. It is the entry ticket to the European market.

No. At this stage, the requirement focuses on formal declarations supported by documentation, not a single mandatory digital platform.

No. As of January 1, 2026, enforcement explicitly tightens around polished diamonds within the relevant scope.

Industry guidance often refers to polished diamonds above 0.50 ct in relevant cases, but you should always confirm the exact requirement with your EU importer before shipping.

If you want, tell me who your typical client is — B2B inventory, a private retail client, or shipments to trade shows — and I’ll adapt this into a one-page checklist and a ready-to-use supplier email tailored to your operation.

VP Of Online Marketing - MID House Of Diamonds

The diamond industry is experiencing a significant shift as lab-grown diamond prices are crashing due to oversupply and increased production in China

Most people don’t realize this, but an engagement ring can lose 30% to 70% of its value the moment it leaves the

The Golconda Blue, a 23.24 ct Fancy Vivid Blue diamond of legendary Golconda origin, is about to make history at Christie’s 2025