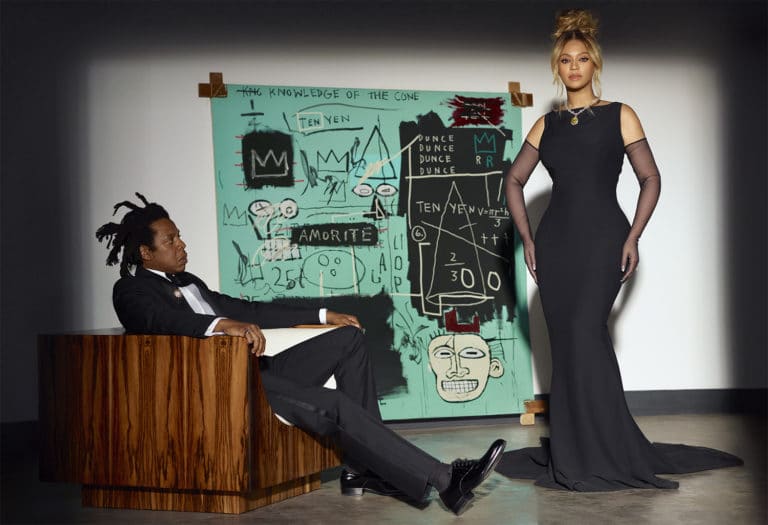

A new ad campaign featuring the flashiest of diamonds and the flashiest of rock stars has generated a media storm that goes beyond what even its planners intended, and says much about the woke society in which we live and operate.

Home » Diamonds blog

Discover

A new ad campaign featuring the flashiest of diamonds and the flashiest of rock stars has generated a media storm that goes beyond what even its planners intended, and says much about the woke society in which we live and operate.

There was a time, not too long ago, when the world’s dominant distributor of rough diamonds, De Beers, not only obstructed efforts aimed at indicating in what specific location a stone was mined, but outwardly declared that it deliberately mixed the supply of goods from its various resources. This, it was understood, would make it impossible to trace provenance.

A speech by Chinese President Xi Jinping about prospective government action to combat the problem of income inequality in the country has put luxury marketers on edge, and precipitated a selloff of stocks of several of the world’s largest luxury brand houses, including LVMH, Kering, Richemont, Prada, Hermès and Moncler.

An era in the diamond trade is about to draw to an end, as Rio Tinto brings its final Argyle Pink Diamonds Tender to Antwerp, Belgium, for the last time in almost four decades. The by-invitation-only event this year will feature 70 rare pink, red, blue and violet diamonds, with a total weight of 81.63 carats, and a record number of stones larger than one carat.

Two years and three months after they last assembled for the United States’ jewelry industry’s signature event, JCK Las Vegas, members of the trade are preparing to do so once again, with its organizers insisting that the show must go on.

A veritable revolution in the luxury markets is currently underway, largely hidden from the Western consumers who dominated the space for most of the past 100 years. It is taking place in Asia, and more specifically in China, and it is being driven by digital retailers, operating online rather than in a brick-and-mortar environment.

The festival of love, Valentine’s Day, is critical focus for the diamond jewelry industry, with its traditional date, February 14, rivaling Mother’s Day as one of the most important non-Christmas sales opportunities in any calendar year.

Verifiably responsible supply chains have fast become a tangible value-adding quality in the diamond and diamond jewelry business, with companies becoming more inclined to trumpet how their sustainability and ethical business practices set themselves and their products apart from their competition.

The mining companies are credited by many as having provided stability to the industry and marketplace during the most difficult months of 2020. By essentially halting supply into the pipeline, they reduced pressure on companies in its midstream, allowing them to reduce excess inventory with the limited number of sales they were still able to make. The result was a relatively rapid recovery of the market when the lockdowns began easing. As a consequence, polished prices began climbing, and do did demand for rough supply. The price of rough followed the same upward trajectory.

Turnover in the diamond sector dipped in 2020, as one would have expected in a year that was dominated by COVID-19. But in contrast to the apocalyptic predictions that were rife at the start the crisis in March, it is fair to say that the industry emerged at the end of December as well as one could reasonably could have hoped. This according to the closely watched diamond pipeline report, prepared each year by TACY’s Pranay Narvekar and Chaim Even Zohar.

It’s not often that that one reads about the discovery of a 1000-plus carat rough diamond, but June 2021 has proven to be an exception to the rule, and the star of the show once again is the Kurowe mine in Botswana.

With reports from the consumer markets indicating increased demand for diamond jewelry and other luxury products, the diamond sector’s two leading producers of rough goods have both reported strong upticks in mine production during the second quarter if the year.

While it would certainly be premature to declare the COVID pandemic as behind us, most indicators in the diamond, jewelry and consumer markets point to a robust recovery in 2021, following what was a very uncertain 2020.

The Kimberley Process, the tripartite international forum that includes representatives of government, industry and civil society, which is dedicated to eliminating the trade in diamonds associated with conflict, concluded its first formal meeting in more than a year and a half, recording little progress on key issues and highlighted by accusations and counteraccusations between civil society representatives and certain of the government delegates.

The Kimberley Process, the tripartite international forum that includes representatives of government, industry and civil society, which is dedicated to eliminating the trade in diamonds associated with conflict, concluded its first formal meeting in more than a year and a half, recording little progress on key issues and highlighted by accusations and counteraccusations between civil society representatives and certain of the government delegates.

It traditionally has been the great divide in jewelry, and indeed has been so lopsided that there has been very little divide all. Jewelry items are traditionally designed to be worn by women, and in fact have largely identified them as female. The market for male jewelry, watches aside, has been growing but remains very small.

It’s not often that that one reads about the discovery of a 1000-plus carat rough diamond, but June 2021 has proven to be an exception to the rule, and the star of the show once again is the Kurowe mine in Botswana.

In contrast to most other luxury products, the fine jewelry category is not dominated by major brand names, at least in terms of sales value. For although the public is a generally aware of names such as Tiffany, Cartier and Bulgari, in terms of actual transactions they currently account for only about 20 percent. But that is likely to change.

2020 was a limbo year for the Kimberley Process, the international forum bringing together representatives of governments, industry and civil society to manage the campaign against conflict diamonds, which it does via the Kimberly Process Certification Scheme. Toward the end of the first quarter, as an increasing number of countries entered strict lockdowns to prevent the spread of the COVID-19 coronavirus, a decision was made by the KP to suspend work as usual, and to do only that which was necessary to enable implementation of the KPCS.

Two massive rough diamonds have been recovered in Botswana in just a few days, with the larger of them being a 1,098-carat stone that is believed to be the third-largest gem-quality diamond ever to have been mined.

The COVID-19 pandemic was a seminal experience for the fine jewelry and watch industries, which suffered a 10 percent to 15 percent revenue decline, but will see its market return, albeit not in quite the same way they existed prior to 2020, writes McKinsey & Company in a report entitled “The State of Fashion: Watches and Jewelry,” co-published with The Business of Fashion.

According to the company, sales at its brick and mortar stores were up almost 106 percent, while ecommerce growth increased by more than 110 percent. Total sales by the group equaled $1.7 billion, up 98.2 percent year over year. eCommerce sales totaled $346.3 million.

Slowly and cautiously the diamond and jewelry industries are inching their way back to normality, with a number of public events scheduled for the second half of the year. While still under the shadow of the ongoing COVID-19 pandemic, their organizers are nonetheless determined to enable face-to-face interaction.

That left Australia’s third diamond producing mine, Merlin, which unlike the other two is not located in Western Australia. With a resource that was considered to be second only to Argyle, it can be found in the vast Northern Territories, 720 kilometers southeast of Darwin and about 80 kilometers south of the dusty town of Borroloola.

While the COVID crisis continues, the slowdown in cases in the Western markets, largely as a result of the continuing vaccination drive, is having a clearly positive impact on sales and trade data.